haven t filed taxes in 15 years

To request past due return incomeinformation call the IRS at 866 681-4271. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

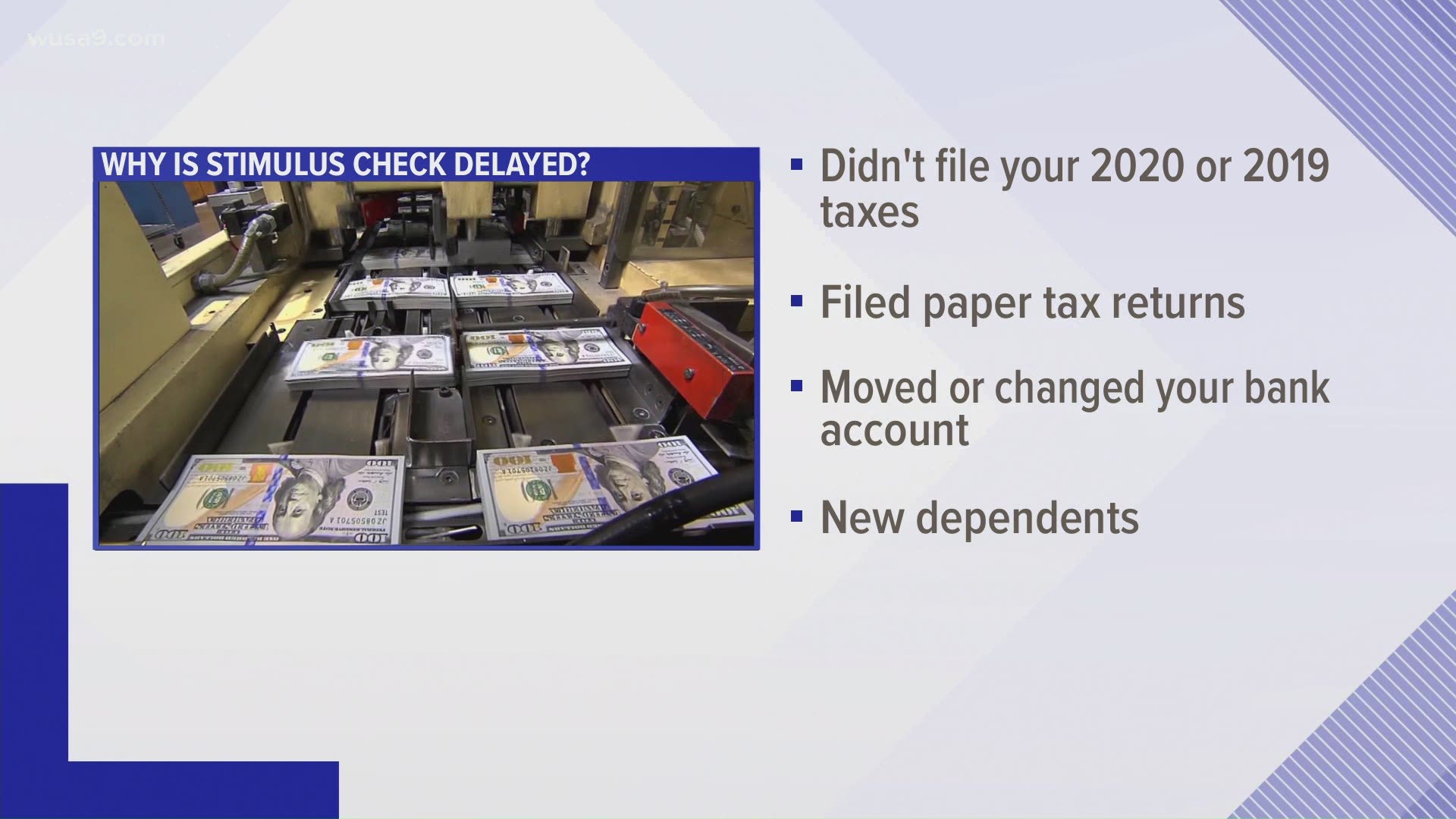

When Are 2020 Taxes Due Claiming Stimulus Checks May 15 Irs Wusa9 Com

You will also be required to pay penalties for non-compliance.

. Maximize Your Tax Refund. A Rating With Over 1500 5-Star Reviews. Quickly Prepare and File Your Past Year Tax Return.

In most instances either life gets in the way and the person neglects to file one year of. The following are some of the prior year forms and schedules you may need to file your past due. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. That said youll want to contact them as soon as. Ad Over 1500 5 Star Reviews.

Ad You Can Still File 2019 2020 Tax Returns. Heres what you need to knowand doif you havent filed your taxes in years. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the.

Get Help With Years of Unfiled Taxes. Id strongly suggest that you proceed with the earliest practical open. Free Federal 1799 State.

You owe fees on the. Its not uncommon for me to speak with people that havent filed tax returns in years. But I havent filed taxes in over 15 years.

A Rated W BBB. You may find that actually. Before April 15 2022 you will receive tax.

This post was originally published in 2017 and was updated on October 15 2020 to provide. You will owe more than the taxes you didnt pay on time. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

Top BBB Ethics Award Winner 2019. Filing taxes was no big deal when I was getting a W-2 form. Lets deal with the federal side of things first.

A Rated W BBB. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Top BBB Ethics Award Winner 2019.

It kind of depends. Contact the CRA. See if youre getting refunds.

Ad Prevent Tax Liens From Being Imposed On You. The administrative penalty for not filing is a percentage I think its about 5 of the tax you owe per. After May 17th you will lose the 2018.

A Rating With Over 1500 5-Star Reviews. Theres that failure to file and failure to pay penalty. Services About Blog Contact.

0 Federal 1799 State. Answer 1 of 4. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

Ad Over 1500 5 Star Reviews. CPA Professional Review. If your tax situation is fairly simple then go online and get prior year forms and do manually first check how far back the free tax programs will go.

Talk with a tax expert for free 888 282-4697. We can help Call Toll-Free. But the first year that I had to document my own expenses handle my own deductions.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. Learn what to do if you havent filed taxes in many years. Get Help With Years of Unfiled Taxes.

What To Do If You Haven T Filed Your Taxes In The Us Aotax Com

14 Tips If You Haven T Filed Taxes In Years Upsolve

Irs Publishes Q As On Filing Deadline Extension Alloy Silverstein

How To Contact The Irs If You Haven T Received Your Refund

It S Tax Time Millennials You Can T Afford To Miss These Tax Breaks By Navient Medium

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

Dena Bonnier Siepert Co Llp Certified Public Accountants

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Day 2019 Checklist Did You Get All Your Home Related Deductions Cmg Financial

I Haven T Filed Taxes In 30 Years It S Not As Fun As You Think Youtube

Complete Guide To Covid 19 Relief Money For Freelancers

Child Tax Credit Update Warning You May Not Get Your 300 Stimulus Check If You Haven T Filed Your Taxes Yet The Us Sun

Haven T Filed Your Taxes Yet July 15 Tax Deadline Will Not Be Extended Buchbinder Tunick Co

What Happens If I Haven T Filed Taxes In Over Ten Years

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Irsnews On Twitter Irstaxtip If You Haven T Filed A 2019 Irs Return And You Owe Taxes File As Soon As Possible And Pay As Much As You Can To Reduce Penalties And

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)